401(k) Plan

A 401(k) plan is an employer-sponsored, tax-advantaged retirement savings plan. These plans fund with pre-tax employee- (and often matching employer-) contributions. Then, the accounts grow tax-free until withdrawal. 401(k) plans often provide employees with a choice of investment options--typically mutual funds.

403(b) Plan

A 403(b) plan is a tax-advantaged retirement savings program. It is available to employees of public education organizations, certain non-profits, and some self-employed ministers. Employees make pre-tax salary deferrals into the plan. These contributions grow tax-deferred until withdrawal.

457 Plan

The 457 Plan is a non-qualified, tax-advantaged, deferred-compensation retirement program. It is available for governmental and some tax-exempt non-governmental organizations. The employer sponsors the plan and the employee defers compensation into it on a pretax or after-tax (Roth) basis. This plan operates similarly to 401(k) and 403(b) plans. However, a key difference is that—unlike those plans—it has no 10% penalty for withdrawal before the age of 55. Still, the withdrawal remains subject to ordinary income taxation.

Annual Rate of Return

Annual rate of return is the gain or loss an investment incurs over the course of a year. This value is a time-weighted annual percentage.

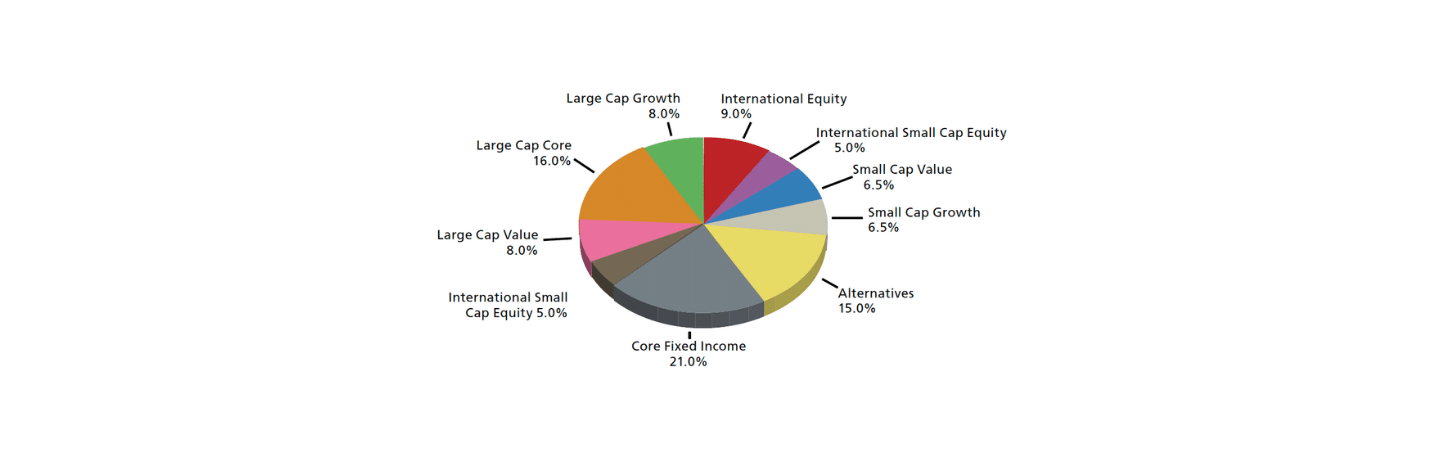

Asset Allocation

Asset allocation is a diversification strategy. The portfolio manager weights select asset asset classes—i.e., stocks, bonds, cash—to minimize risk and maximize return. For example, a typical allocation might be 60% stocks, 30% bonds, and 10% cash. Periodically, the manager will adjust the percentages to reflect changes in investor goals, time frame, risk tolerance, and market outlook, etc.

Asset Class

An asset class is a category of investments with similar characteristics and behaviors in the marketplace. Examples of asset classes include cash, stocks, bonds, real estate, commodities, and so forth.