Annual Rate of Return

Annual rate of return is the gain or loss an investment incurs over the course of a year. This value is a time-weighted annual percentage.

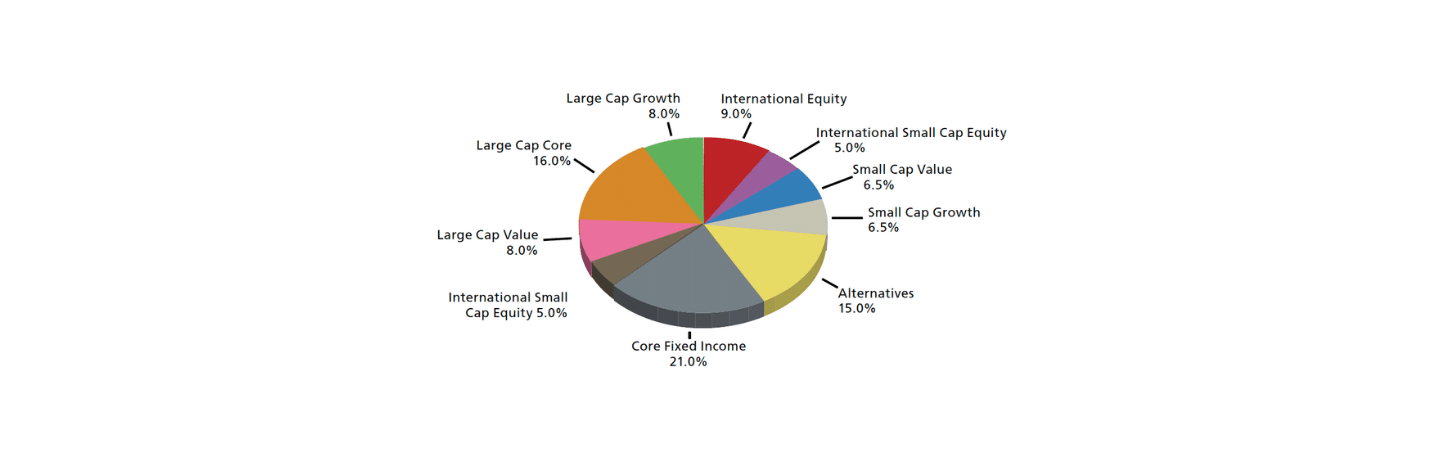

Asset Allocation

Asset allocation is a diversification strategy. The portfolio manager weights select asset asset classes—i.e., stocks, bonds, cash—to minimize risk and maximize return. For example, a typical allocation might be 60% stocks, 30% bonds, and 10% cash. Periodically, the manager will adjust the percentages to reflect changes in investor goals, time frame, risk tolerance, and market outlook, etc.

Asset Class

An asset class is a category of investments with similar characteristics and behaviors in the marketplace. Examples of asset classes include cash, stocks, bonds, real estate, commodities, and so forth.

Basis Point

A basis point is a unit of percentage measure equal to 0.01%. This value often expresses changes in interest rates, equity indices, and fixed-income securities.

Bond

A bond is a debt instrument with a maturity of more than one year. Bond issuers include the federal government, local governments, utilities, corporations, and several other types of institutions. These issuers (borrowers) promise to repay the investors (lenders) the principal loan amount at a specified time. In addition, interest-bearing bonds make periodic interest payments.