Annual Rate of Return

Annual rate of return is the gain or loss an investment incurs over the course of a year. This value is a time-weighted annual percentage.

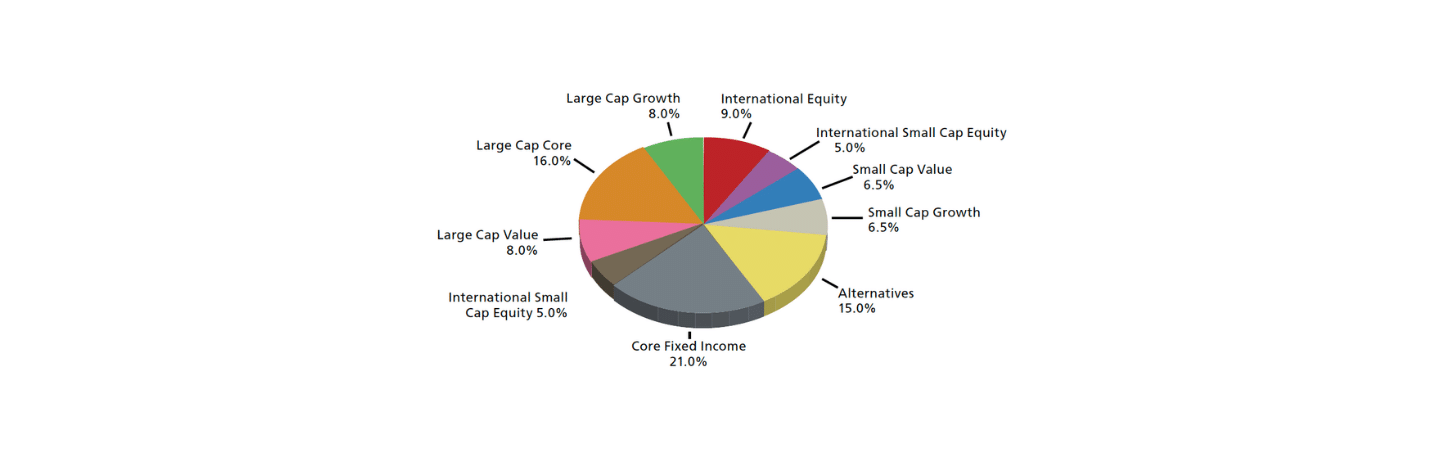

Asset Allocation

Asset allocation is a diversification strategy. The portfolio manager weights select asset asset classes—i.e., stocks, bonds, cash—to minimize risk and maximize return. For example, a typical allocation might be 60% stocks, 30% bonds, and 10% cash. Periodically, the manager will adjust the percentages to reflect changes in investor goals, time frame, risk tolerance, and market outlook, etc.

Asset Class

An asset class is a category of investments with similar characteristics and behaviors in the marketplace. Examples of asset classes include cash, stocks, bonds, real estate, commodities, and so forth.